Beyond the Classroom: Why the Class of 2026 Needs a "Financial Shield" Before Graduation

- Diapers 2 Deposits

- 5 days ago

- 2 min read

OVERLEA, MD. — January 7, 2026, As the Class of 2026 enters its final semester, a new national initiative is set to launch from Baltimore to help students navigate what experts are calling a "Graduation Ambush" of predatory debt.

Whitney Ramirez, AFC®, Founder of Diapers 2 Deposits, Inc., announced today that she will join Dr. Stephanie Poplar on WOLB 1010 AM’s "Community Conversations" next week to unveil the 'Diplomas vs. Debt' Challenge. The appearance, scheduled for Friday, January 16th at 2 PM EST, serves as the public kickoff for a campaign designed to equip graduating seniors with high-level credit strategies typically reserved for financial professionals.

A Movement Born from a Mother’s Plea

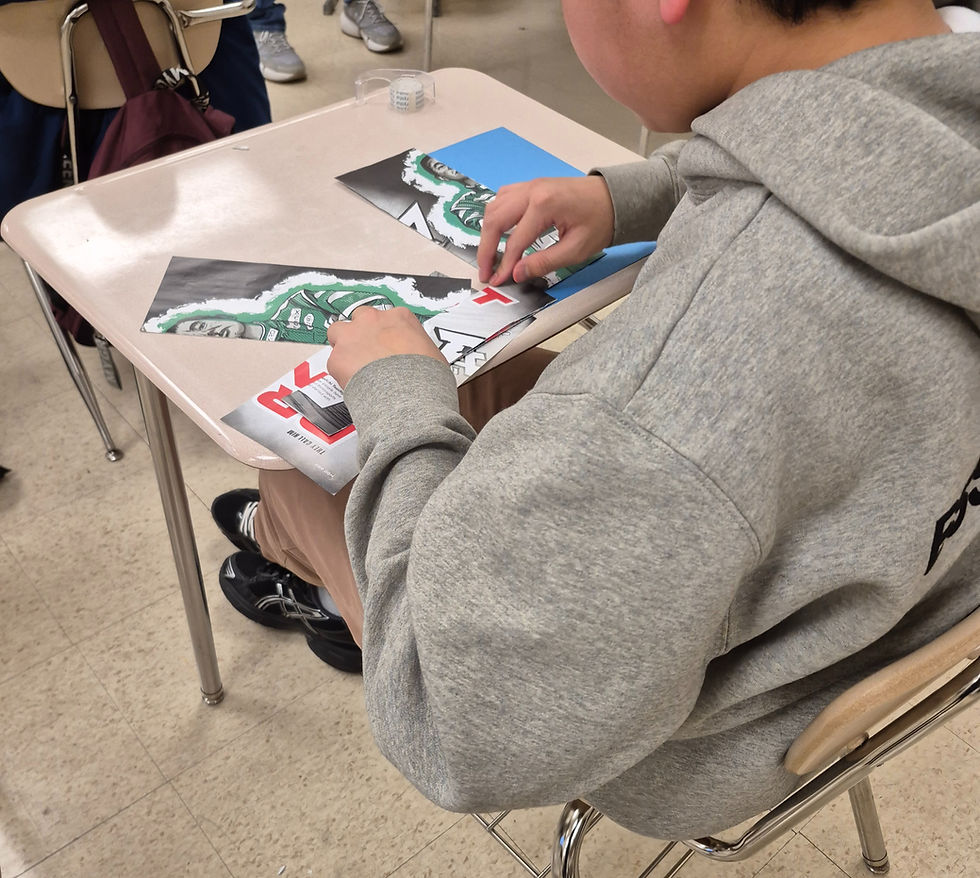

The initiative was inspired by a recent Baltimore mother who, after seeing her teens participate in a Diapers 2 Deposits session, asked a critical question: "Can my teens take this more than once? They need to hear this message multiple times."

For Ramirez, this wasn't a sign that the first lesson failed—it was a sign that parents recognize the scale of the "billion-dollar marketing machines" targeting their children.

"Our sessions at Diapers 2 Deposits provide the spark and the strategy," says Ramirez, the Maryland Chamber of Commerce 2025 'Rising Star.' "But the 'Diplomas vs. Debt' Challenge is about moving from a single lesson to a lifelong Financial Shield. In a world that wants our children in debt, mastery must be reinforced until it becomes second nature."

Beyond Basic Budgeting for the Class of 2026

While many school programs focus on simple math, the 'Diplomas vs. Debt' Challenge focuses on systemic mastery. On Jan 16th, Ramirez is expected to outline her "Financial Shield" strategy, which teaches students to use credit to fund their lifestyle while making interest payments optional.

Key pillars of the upcoming challenge include:

Mastering the Grace Period: How to use the bank's money for free.

The No-Co-Sign Mandate: Preserving family wealth by avoiding shared debt traps.

Predatory Offer Recognition: Identifying the "graduation specials" that lead to long-term debt cycles.

Tune In for the Launch

The launch on WOLB 1010 AM marks a major media push for the award-winning organization, which was recently named the Rising Star by the Maryland Chamber of Commerce.

"Dr. Stephanie Poplar has a unique pulse on the needs of Baltimore’s families," Ramirez noted.

About Diapers 2 Deposits, Inc.

Diapers 2 Deposits, Inc. is a financial education organization based in Overlea, Md., committed to strategic financial readiness from the "diapers stage to the first deposit." Through its signature F.A.S.T. Framework, the organization serves thousands of students across DC, MD, and NYC and is currently expanding its Spring 2026 national tour.

Media Contact

Organization: Diapers 2 Deposits, Inc.

Email: savvy@diapers2deposits.com

Phone: (844) 70 - SAVVY (72889)

Website: www.diapers2deposits.com

Comments