Parents Advocate for Financial Literacy as Graduation Approaches

- Diapers 2 Deposits

- 6 days ago

- 2 min read

BALTIMORE, MD — December 31, 2025 6:00 AM EST

Parents advocate for financial literacy as graduation approaches for the Class of 2026, parents across the country are increasingly raising concerns about whether students are prepared for the financial responsibilities they will face immediately after high school. While academic readiness remains a priority, many families say practical financial knowledge is just as critical during the transition to adulthood.

For parents of graduating seniors, questions around budgeting, credit use, employment income, and housing often arise well before diplomas are awarded. These concerns have become more visible as families observe how quickly young adults are expected to navigate financial systems with little margin for error.

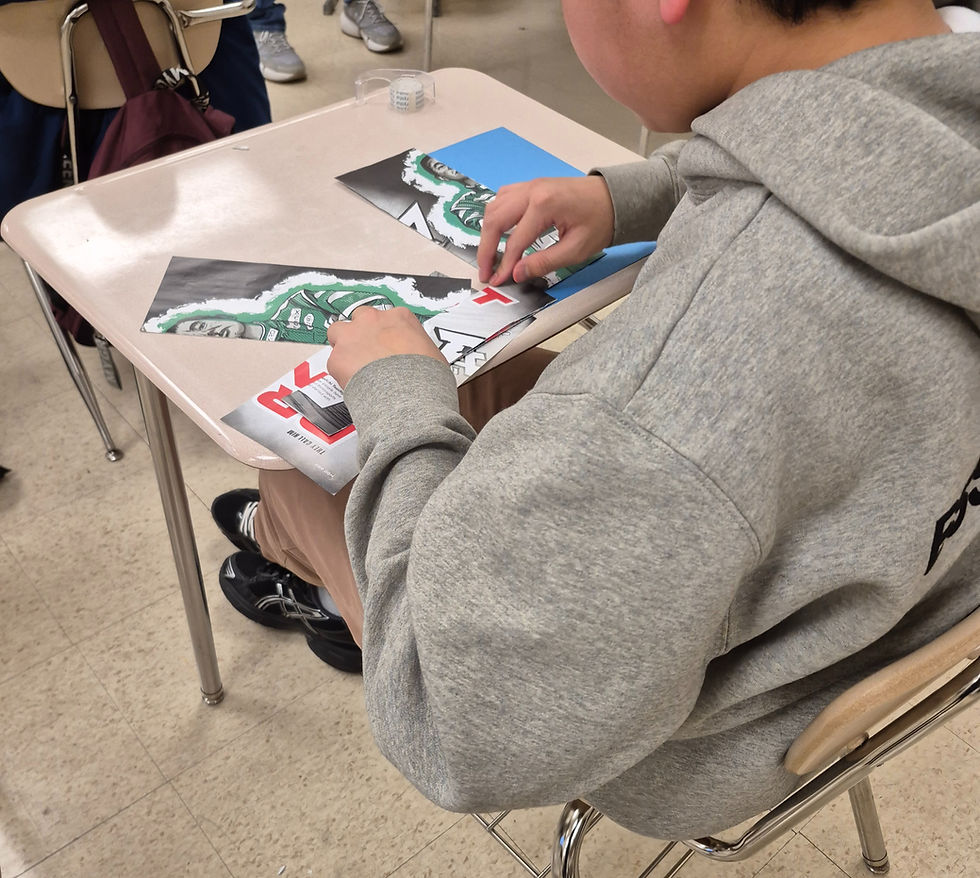

Recent education reporting has highlighted the effectiveness of experiential financial literacy programs that allow students to practice financial decision-making in realistic scenarios. Coverage of school-based initiatives in Montgomery County, Maryland, for example, has shown that students are more engaged when lessons focus on real-world applications, prompting parents to question why similar preparation is not more widely available before graduation.

Many parents say their advocacy is not rooted in criticism of schools, but rather in a desire to ensure students are equipped for life beyond the classroom. As graduation timelines tighten, families are increasingly vocal in conversations with educators, parent-teacher associations, and school leadership about how financial readiness fits into broader student support efforts.

“Parents often see the financial challenges coming before students experience them,” said Whitney Ramirez, CEO of Diapers 2 Deposits, a financial literacy organization that works with schools and families. “By the time graduation arrives, families want reassurance that students have had an opportunity to learn how to navigate those responsibilities.”

Parent advocacy has taken many forms, from informal conversations to organized discussions within PTAs and parent associations. In some cases, families have encouraged schools to explore short-term financial literacy programs that can be delivered during the school day, particularly in the final months of senior year, when students are preparing for life transitions.

Education leaders note that parent input often plays a significant role in shaping graduation readiness initiatives. As families express growing concern about financial preparedness, schools are increasingly evaluating how life skills education fits alongside academic instruction and postsecondary planning.

While approaches vary by district, the underlying sentiment among parents remains consistent: financial literacy is not an optional skill, but a foundational component of student readiness. As graduation approaches, many families are advocating for earlier exposure to financial decision-making concepts to help students enter adulthood with greater confidence and clarity.

As schools continue planning for the final semester of the academic year, parent voices are expected to remain influential in discussions on how best to support graduating seniors during this pivotal transition.

About Diapers 2 Deposits

Diapers 2 Deposits is a financial literacy organization providing education programs and initiatives designed to support student readiness and real-world financial decision-making for youth and families.

Media Contact:

Diapers 2 Deposits, Inc.

Overlea, Maryland

844 70-SAVVY

Comments