Beyond Dollars and Cents: Why Emotion is the New Frontier in Early Financial Literacy

- Diapers 2 Deposits

- Jan 6

- 2 min read

Summary: As financial education reaches elementary classrooms, educators find that "money moves" are driven by emotions long before they become math problems, leading to a new focus on Social-Emotional Learning (SEL).

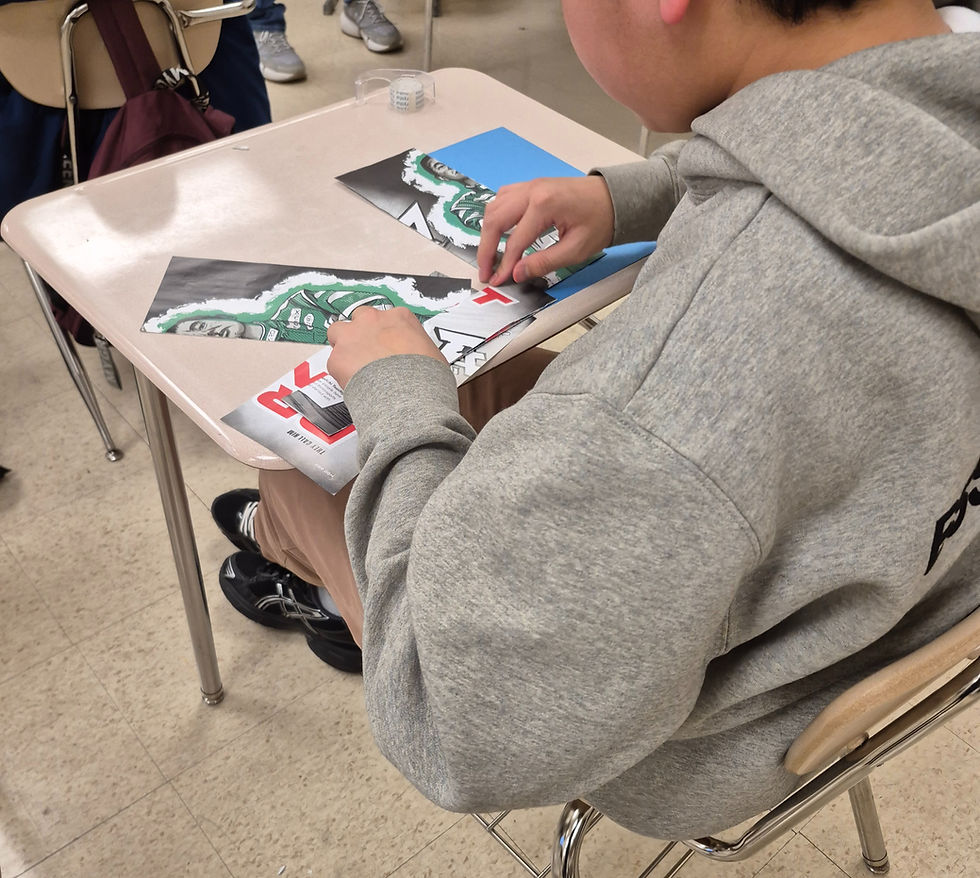

MARYLAND, USA - January 5, 2026 As financial literacy education expands into elementary classrooms across the country, a surprising trend is emerging: money lessons are surfacing deep emotional responses long before students encounter real-world financial consequences.

Experts say these "classroom moments" highlight why early financial education is most effective when paired with Social-Emotional Learning (SEL). Rather than just teaching kids how to count change, teachers are now helping them manage the frustration of a limited budget and the ethics of a "need" versus a "want."

The "Emotional Reality" of Early Money Decisions

Financial educators report that lessons on budgeting frequently prompt reflection and even emotional processing that mirrors adult financial stress.

“Children don’t experience money as abstract concepts,” says Whitney Ramirez, an Accredited Financial Counselor® (AFC®) and leading financial literacy educator. “They experience money through choice, control, and limits, often tied closely to emotion.”

Case Study: Logic vs. Emotion in the Classroom

In a recent session, a student argued that clothing was a "want" rather than a "need" because he wanted to keep all his money. While technically incorrect, educators viewed this as a critical expression of prioritization and autonomy.

Instead of a simple correction, facilitators used the moment to explore:

Trade-offs: What happens if we skip a "need"?

Personal Values: Why do we feel that a "want" is more important?

Self-Awareness: Identifying the "feeling" of saving versus spending.

Merging Financial Literacy with the CASEL Framework

The Collaborative for Academic, Social, and Emotional Learning (CASEL) identifies five core competencies that are now being woven directly into financial curriculum:

Self-Awareness: Identifying one's feelings about money limits.

Self-Management: Practicing impulse control when shopping.

Social Awareness: Understanding how financial choices affect families.

Relationship Skills: Negotiating "group budgets" in simulations.

Responsible Decision-Making: Evaluating the long-term impact of a purchase.

Designing the 2026 Curriculum

Experts emphasize that the most successful programs in 2026 are experiential and culturally responsive. Modern elementary programs are moving away from lectures in favor of:

Play-based simulations: Creating classroom economies.

Storytelling: Using characters to model financial dilemmas.

Guided Discussion: Treating mistakes as learning opportunities rather than failures.

“Financial well-being is deeply connected to emotional well-being,” Ramirez noted. “When students explore both early on, they build a stronger foundation for future financial choices.”

About Diapers 2 Deposits

Diapers 2 Deposits, Inc. is an award-winning financial literacy organization dedicated to bridging the gap between abstract money concepts and real-world financial readiness. Founded by Whitney Ramirez, AFC®, the organization specializes in a "cradle-to-career" approach, empowering students, families, and educators through its signature F.A.S.T. Framework (Financial Field Trips, Practical Application & Activities, Standards, and Theories).

Based in Baltimore County, Maryland, the organization serves school districts and community partners nationwide to ensure every child—regardless of socioeconomic background—is equipped for long-term economic empowerment.

Media Contact Info

For interviews, high-resolution images, or additional information, please contact:

Contact Name: Whitney Ramirez

Title: Founder & CEO, Diapers 2 Deposits, Inc.

Phone: 202-967-8289

Website: www.diapers2deposits.com

Location: Overlea, Maryland

Comments